How does it Work?

1. Complimentary Introductory Call

- Start your journey with a free 20-minute introductory call, where we will discuss your needs and explore how I can support your financial goals.

- Before we meet, I will send you a Financial Health Assessment. This 35-question comprehensive assessment will ask a variety of financial behavior questions. The results will provide personalized insights and help us create an action plan.

2. Select a Package

- Everyone is at a different point in their financial journey. Depending on your goals and desired pace, you can choose from 3 packages: Essentials, Plus, or Premium. Not sure which to choose? That's okay, we will assess your situation and decide which best fits your needs. Outside of the scheduled meetings, you will have unlimited access to me via email.

- First Meeting: Discovery Session

- This 1-hr session will be for us to discuss your current financial situation. I will guide the conversation with tailored questions. We will focus on identifying and selecting your financial goals. Post-session, you will have some assignments to complete so I can develop a customized plan for you.

- Second Meeting: Planning Session

- During this 1-hr session we will dig deeper into your financials and accounts. We will develop your personal income statement and balance sheet which will guide future modeling.

- Third Meeting: Solutions Session

- During this 1-hr session we will review a financial roadmap made just for you, clarify any questions, and refine your strategy.

- Follow-up Meetings: Accountability Check-In:

- We know life sometimes gets in the way of getting things done. That's why 30-minute Accountability Check-Ins are so important to help us make sure progress is being made.

- First Meeting: Discovery Session

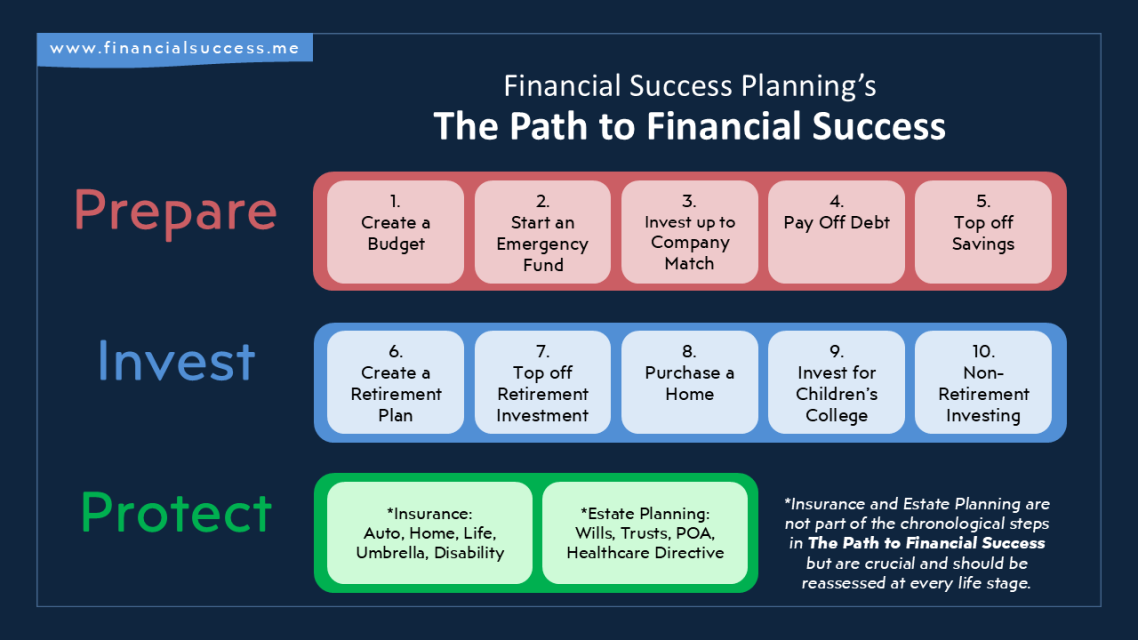

During our meetings I will guide you through the Financial Planning Process and we will leverage The Path to Financial Success which is a roadmap that I developed to help people achieve their financial goals.

During our meetings we can cover a wide variety of topics, including but not limited to...

- Budgeting, debt management plan, and creating an emergency fund

- Investing in retirement and non-retirement funds

- Identifying retirement needs and goals

- Tax advantaged accounts

- Large purchase guidance including home and car

- Understanding the importance of Estate Planning (Trusts, Wills, and Healthcare Directives)

- Life Insurance: do you need it, how much, and what kind?

- Financial changes when expecting a baby

- Wedding Budget Planning, Newlywed Financial Planning

- Financial "Setup for Success" after landing your first job